Managing money can feel overwhelming, especially when income seems to disappear before the end of the month. Many people know they should budget, save, and plan for the future, but struggle to find a method that feels simple, realistic, and sustainable. This is where the 50/30/20 method stands out. Instead of complex spreadsheets or strict rules, it offers a clear framework that helps people organize their finances without feeling restricted or stressed.

The appeal of the 50/30/20 method lies in its balance. It recognizes that money is not only about paying bills and saving for the future, but also about enjoying life in the present. By dividing income into three broad categories, the method provides structure while still allowing flexibility. For beginners especially, this approach can feel approachable and empowering rather than intimidating.

This article explains how the 50/30/20 method works and, more importantly, how to apply it in real life. The goal is not to present it as a perfect system, but as a practical tool that can be adapted to different incomes, lifestyles, and financial goals.

What the 50/30/20 Method Really Is

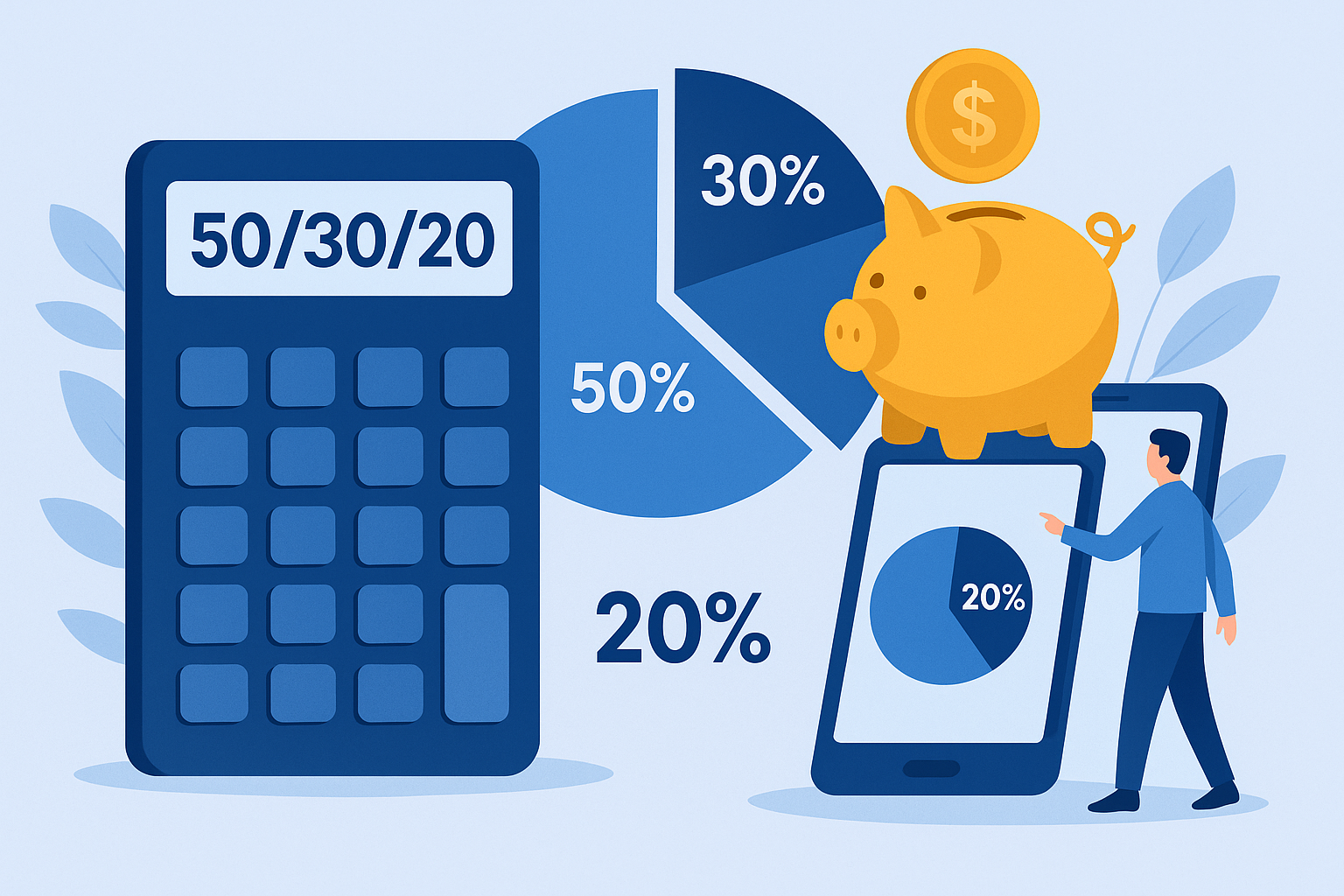

The 50/30/20 method is a simple budgeting framework that divides your after-tax income into three main categories. Fifty percent is allocated to needs, thirty percent to wants, and twenty percent to savings and financial goals. Rather than tracking every single expense in detail, the method focuses on big-picture balance.

Needs include essential expenses required to live and work, such as housing, utilities, food, transportation, and basic insurance. Wants cover discretionary spending that improves quality of life but is not strictly necessary, such as dining out, entertainment, hobbies, and travel. Savings include emergency funds, investments, retirement contributions, and debt repayment beyond minimum payments.

By working with percentages instead of fixed amounts, the method adapts naturally to changes in income. This flexibility is one of the reasons it remains popular among people at different stages of their financial journey.

Why the 50/30/20 Method Works for So Many People

One reason the 50/30/20 method works is that it simplifies decision-making. Instead of asking whether every purchase is “allowed,” you only need to know which category it belongs to and whether you are staying within your overall limits. This reduces mental fatigue and makes budgeting feel less restrictive.

Another reason is that it reflects real life. The method acknowledges that enjoying money is part of financial well-being. Allowing room for wants helps prevent burnout and resentment, which are common reasons people abandon budgets.

For beginners, the method also provides a clear starting point. It creates structure without requiring advanced financial knowledge or constant monitoring, making it easier to maintain over time.

Understanding the “Needs” Category in Practice

The “needs” category represents essential expenses that support basic living. These are costs that are difficult or impossible to eliminate entirely. Housing typically takes up the largest portion, followed by utilities, groceries, transportation, and healthcare-related expenses.

In real life, distinguishing needs from wants can be challenging. For example, basic internet access may be a need for work, while premium streaming services are usually wants. The goal is not to judge spending, but to classify it accurately.

Keeping needs close to fifty percent of income helps maintain stability. If needs consistently exceed this threshold, it may signal that adjustments are needed, such as reevaluating housing costs or transportation choices.

How to Define “Wants” Without Feeling Guilty

Wants include non-essential expenses that enhance comfort, enjoyment, and personal satisfaction. This category is often misunderstood as unnecessary or irresponsible spending, but it plays an important role in maintaining balance.

In real life, wants vary widely depending on lifestyle, values, and priorities. For one person, dining out may be a significant want, while for another it may be travel or hobbies. The method allows for personalization rather than imposing rigid rules.

Allowing space for wants helps make the budget sustainable. When people completely eliminate enjoyable spending, they are more likely to abandon their financial plan altogether.

The Importance of the “Savings” Category

The savings portion of the 50/30/20 method represents future-focused financial decisions. This category includes building an emergency fund, contributing to investments, saving for long-term goals, and paying down debt beyond minimum requirements.

Saving twenty percent of income may feel challenging at first, especially for beginners. However, the percentage serves as a guideline rather than an absolute rule. What matters most is consistent progress over time.

This category creates financial resilience. It prepares you for unexpected expenses, supports long-term stability, and reduces reliance on debt.

Applying the 50/30/20 Method to Your Real Income

Applying the method begins with understanding your after-tax income. This is the amount you actually receive and can allocate. Once you know this number, you can calculate approximate targets for each category.

For example, fifty percent of income can be allocated to needs, thirty percent to wants, and twenty percent to savings. These figures provide a reference point rather than strict limits.

Real-life application requires flexibility. Some months may deviate slightly, and that is normal. The goal is balance over time, not perfection in every paycheck.

Adjusting the Method to Fit Your Situation

Not everyone can follow the 50/30/20 split exactly, especially in high-cost living areas or during periods of financial transition. Adjustments are both normal and necessary.

If needs exceed fifty percent, you may temporarily reduce spending in the wants category or adjust savings goals. If income increases, you may choose to save more than twenty percent. The method is meant to guide decisions, not constrain them. Adapting the framework to your reality makes it more effective and sustainable.

Using the Method With Irregular Income

For people with irregular income, such as freelancers or self-employed individuals, applying the 50/30/20 method requires averaging income over time. Looking at several months rather than a single paycheck provides a clearer picture.

In these cases, flexibility becomes even more important. Savings may fluctuate, but maintaining awareness of overall balance helps prevent overspending during high-income periods. The method can still provide structure, even when income is unpredictable.

Common Mistakes When Using the 50/30/20 Method

One common mistake is misclassifying expenses. When too many wants are labeled as needs, the method loses effectiveness. Honest classification is essential for clarity.

Another mistake is treating the percentages as rigid rules. The method is a guideline, not a test. Flexibility is key to long-term success. Finally, some people abandon the method too quickly. Like any financial habit, it takes time to adjust and refine.

How the 50/30/20 Method Supports Long-Term Financial Health

Over time, the 50/30/20 method encourages mindful spending and intentional saving. It creates awareness of financial patterns and highlights areas for improvement. The method also supports long-term goals by ensuring that saving and investing are prioritized alongside daily living expenses. This balance helps build confidence and reduces financial anxiety.

Combining the Method With Other Financial Tools

The 50/30/20 method works well alongside other financial tools such as budgeting apps, savings accounts, and investment platforms. These tools help track progress and automate decisions. Automation, in particular, supports consistency. Automatically allocating savings reduces the temptation to overspend. Using simple tools enhances the effectiveness of the method without adding complexity.

Applying the Method to Debt Repayment

Debt repayment fits naturally into the savings category of the 50/30/20 method. Paying more than minimum balances supports long-term stability and reduces financial stress.

Balancing debt repayment with savings is important. Focusing exclusively on debt without building a small buffer can increase vulnerability to unexpected expenses. The method encourages a balanced approach that supports progress without overwhelm.

Teaching the Method as a Foundation for Financial Education

The simplicity of the 50/30/20 method makes it an excellent educational tool. It introduces core financial concepts without requiring advanced knowledge. For beginners, it builds confidence and provides a clear framework for decision-making. This foundation supports further learning and growth.

Recognizing When the Method Needs Adjustment

As life changes, financial strategies should evolve. Changes in income, family size, or goals may require adjusting the percentages. Recognizing these moments ensures that the method continues to serve your needs rather than restrict them. Flexibility supports long-term success.

The Emotional Benefits of a Balanced Budget

Beyond numbers, the 50/30/20 method offers emotional benefits. It reduces guilt around spending and anxiety around saving. Knowing that money is allocated intentionally provides peace of mind and a sense of control. This emotional balance is often overlooked but deeply valuable.

Building Consistency Over Perfection

Consistency matters more than perfect adherence. Some months will align closely with the ideal percentages, while others will not. The method encourages long-term balance rather than short-term precision. This mindset supports sustainability.

How the Method Fits Into a Broader Financial Plan

The 50/30/20 method works best as part of a broader financial plan. It complements goals such as investing, debt reduction, and long-term security. Used together, these elements create a cohesive financial strategy. The method provides structure without limiting growth.

Evaluating Progress Over Time

Regularly reviewing how your spending aligns with the method helps identify trends and opportunities for improvement. Evaluation should be constructive rather than critical. Progress builds through awareness.

Final Thoughts on the 50/30/20 Method in Real Life

The 50/30/20 method is not about restriction, but balance. It offers a practical framework for managing money in a way that supports both present enjoyment and future security. Applied thoughtfully, it helps reduce stress, build confidence, and create sustainable financial habits. The key is adaptation, honesty, and consistency. In real life, financial success is not about following rules perfectly, but about creating systems that support your values and goals over time.

Nanda Cardoso is a personal finance writer focused on financial education, money habits, and financial well-being. The content published on this site is for educational purposes only and does not constitute financial advice.