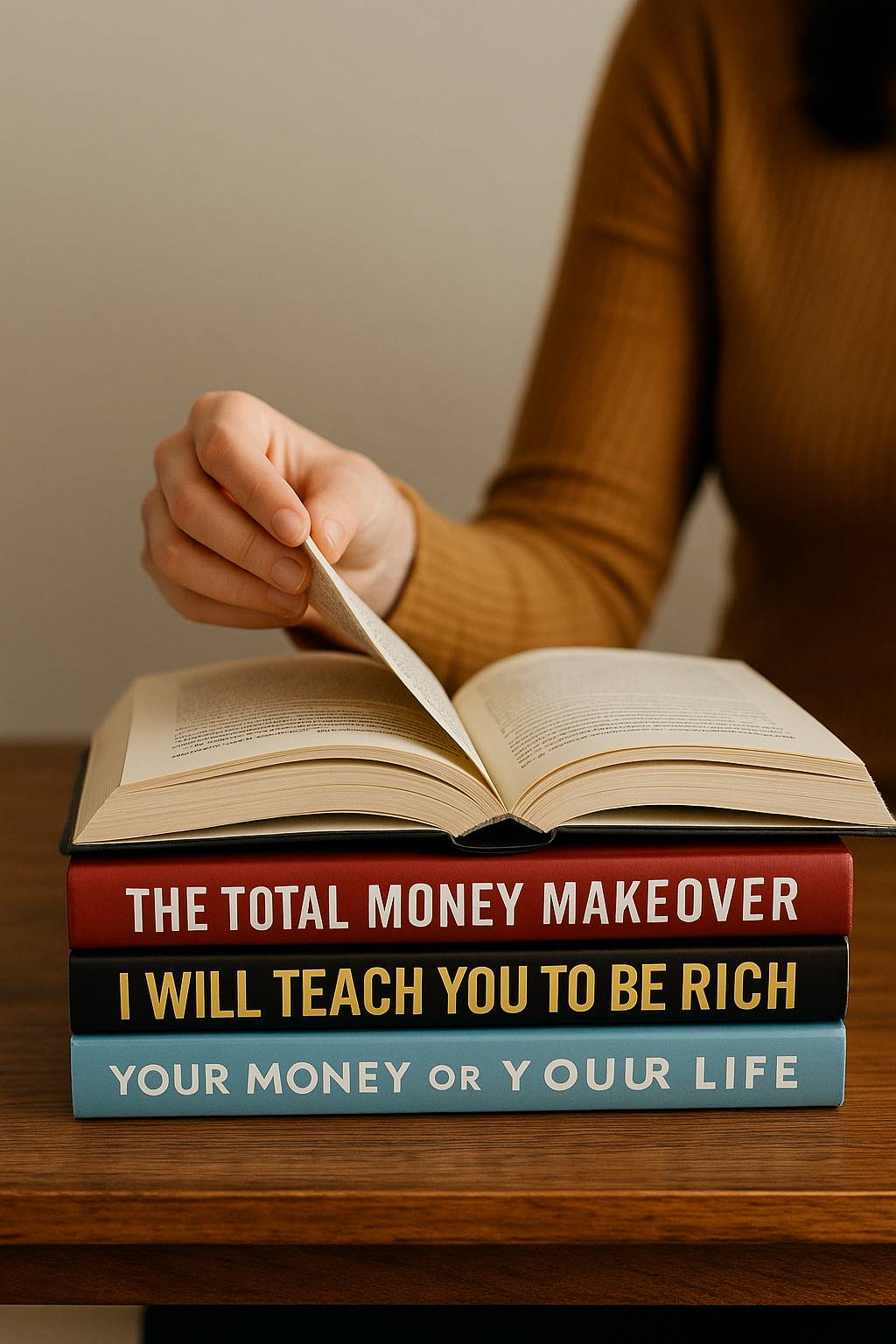

Why Reading Is One of the Best Ways to Learn About Money

For many people, personal finance feels confusing, intimidating, or overly technical. Numbers, charts, and financial jargon can create distance instead of understanding. Reading books about finance changes this dynamic. Books allow you to learn at your own pace, absorb concepts gradually, and reflect on ideas without pressure. They also provide context, stories, and real-life examples that make abstract concepts easier to understand. Unlike short online content, books offer depth and continuity, helping readers build a solid foundation rather than fragmented knowledge. For beginners, reading is one of the most effective ways to develop financial awareness, confidence, and long-term understanding. Books do not just teach how money works; they reshape how you think about money.

How Simple Financial Books Build Confidence Instead of Fear

Many people avoid financial topics because they associate them with stress or past mistakes. Simple financial books take a different approach. They focus on clarity, mindset, and practical understanding rather than complexity. These books speak directly to everyday experiences, showing that financial challenges are common and manageable. When readers see themselves reflected in these stories, fear is replaced by curiosity. Confidence grows because learning feels accessible instead of overwhelming. Simple books emphasize progress over perfection, encouraging readers to start where they are rather than waiting for ideal conditions. This emotional shift is crucial because confidence is often the missing ingredient in financial improvement.

Understanding That Financial Education Is a Process

One of the most important lessons simple financial books teach is that learning about money is a journey, not a single event. No book magically fixes financial problems overnight. Instead, each book adds a layer of understanding that builds over time. Some books focus on mindset, others on habits, and others on long-term planning. Together, they create a complete picture. Simple books respect this process and guide readers gently through it. They encourage patience, consistency, and self-compassion. Understanding that financial education evolves helps readers stay engaged and motivated, even when progress feels slow.

Books That Focus on Financial Mindset and Behavior

Before learning advanced strategies, it is essential to understand the psychological side of money. Many simple finance books focus on mindset because behavior drives financial outcomes more than knowledge alone. These books explore how beliefs, emotions, and habits influence spending, saving, and investing. They explain why people repeat the same mistakes and how small behavioral changes can lead to significant improvements. By addressing mindset first, these books help readers break unhealthy patterns and build a healthier relationship with money. This foundation makes all other financial concepts easier to apply. Without mindset work, even the best strategies often fail.

Why Storytelling Makes Financial Concepts Easier to Understand

Some of the most effective finance books use storytelling instead of technical explanations. Stories make ideas relatable and memorable. When readers follow characters through financial successes and failures, they learn through experience rather than theory. Story-based books show consequences, choices, and outcomes in a way that feels natural. This approach removes intimidation and increases engagement. Readers are more likely to finish these books and apply what they learn because the lessons feel relevant and human. Storytelling transforms finance from a cold subject into a meaningful life skill.

Books That Teach the Basics Without Overcomplication

For beginners, simplicity is essential. Books that explain budgeting, saving, debt, and investing in plain language create clarity instead of confusion. These books avoid unnecessary jargon and focus on core principles that apply regardless of income level. They explain concepts step by step, allowing readers to build understanding gradually. This approach helps readers avoid feeling lost or discouraged. When the basics are clear, readers feel empowered to take action. Simple explanations build trust and confidence, making financial growth feel achievable rather than intimidating.

Understanding the Role of Habits in Financial Success

Many simple finance books emphasize habits over tactics. They show that long-term financial success comes from consistent behavior rather than occasional big decisions. These books explain how daily choices, routines, and systems shape financial outcomes over time. Readers learn that small habits, repeated consistently, create powerful results. This perspective reduces pressure because it shifts focus away from drastic changes. Instead of trying to do everything at once, readers learn to improve gradually. Habit-focused books encourage sustainability, which is essential for lasting financial health.

Books That Introduce Investing in a Calm and Practical Way

Investing is one of the most intimidating topics for beginners. Simple investment books help demystify this area by explaining concepts clearly and calmly. They emphasize long-term thinking, patience, and diversification rather than speculation or quick gains. These books help readers understand risk without fear and growth without unrealistic expectations. By presenting investing as a gradual process rather than a gamble, they encourage beginners to participate confidently. This approach helps readers overcome paralysis and begin building wealth steadily.

Why Some Books Are Better for Beginners Than Others

Not all finance books are suitable for beginners. Some assume prior knowledge or focus heavily on advanced strategies. Simple books stand out because they meet readers where they are. They acknowledge confusion, mistakes, and uncertainty as normal parts of the learning process. These books prioritize clarity, encouragement, and realism. They avoid promoting extreme lifestyles or unrealistic promises. This balance makes them trustworthy and effective. Beginners benefit most from books that educate without judgment and inspire without exaggeration.

How Reading Changes Your Financial Identity

Reading about finance does more than provide information; it reshapes identity. As readers learn, they begin to see themselves as capable of managing money. This identity shift influences behavior naturally. Decisions become more intentional, confidence increases, and fear decreases. Simple books support this transformation by reinforcing positive beliefs about growth and learning. They remind readers that financial skills are learned, not inherited. Over time, this new identity supports better choices and long-term stability.

Creating a Reading Habit That Supports Financial Growth

Consistency matters when it comes to reading. Even a few pages a day can lead to meaningful insight over time. Simple finance books are especially effective because they are easy to pick up and continue reading without mental exhaustion. Creating a reading habit supports continuous learning and reflection. This habit keeps financial goals visible and reinforces positive behavior. Over time, reading becomes a source of motivation rather than obligation. The key is not how fast you read but how consistently you engage with the material.

Applying What You Learn Without Pressure

One of the biggest mistakes readers make is trying to apply everything at once. Simple books encourage gradual implementation. They emphasize reflection and adaptation rather than immediate transformation. Applying one idea at a time allows habits to form naturally. This approach reduces frustration and increases success. Books that respect this pace help readers build confidence through small wins. Financial improvement becomes sustainable because it fits into real life rather than disrupting it.

Why Books Remain Relevant in the Digital Age

Despite the abundance of online content, books remain one of the most reliable sources of financial education. They offer depth, coherence, and thoughtful structure. Simple finance books filter noise and present ideas in a logical sequence. This helps readers avoid misinformation and conflicting advice. Books also encourage deeper focus, which improves understanding and retention. In a world of distractions, books provide a space for meaningful learning and reflection.

Final Thoughts

Simple financial books play a powerful role in helping people understand money without fear or confusion. They build confidence, reshape mindset, and provide practical guidance that supports long-term growth. By focusing on clarity, behavior, and gradual learning, these books make financial education accessible to everyone. Reading is not about becoming an expert overnight; it is about becoming more aware, intentional, and confident with each page. When chosen wisely, simple finance books become trusted companions on the journey toward financial stability and independence. They remind readers that understanding money is not reserved for experts—it is a skill anyone can develop with patience and curiosity.

Nanda Cardoso is a personal finance writer focused on financial education, money habits, and financial well-being. The content published on this site is for educational purposes only and does not constitute financial advice.