Financial stress is one of the most common sources of anxiety in modern life. It affects people across different income levels, backgrounds, and stages of life. While financial stress is often associated with external factors such as income, debt, or unexpected expenses, its roots and consequences go much deeper. One of the most overlooked aspects of financial stress is its close relationship with daily habits.

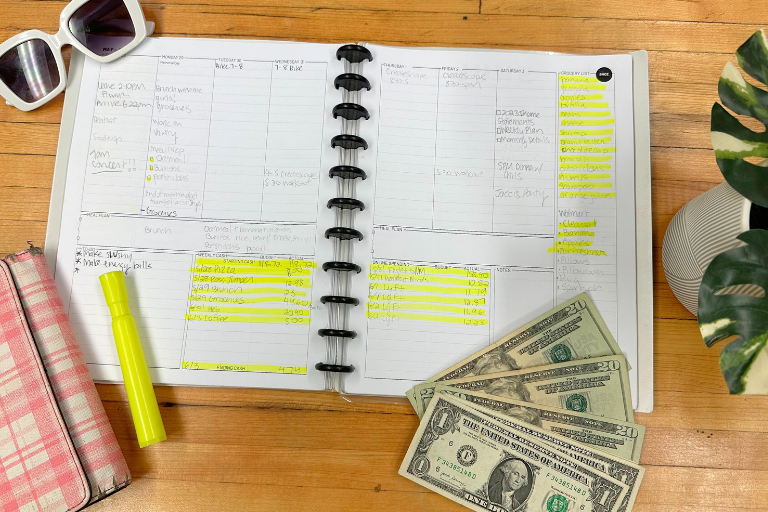

Daily habits shape how people earn, spend, save, and think about money. Over time, these habits can either reduce financial stress or quietly intensify it. Many individuals focus on major financial events when trying to improve their situation, but it is the everyday routines and behaviors that usually have the greatest long-term impact.

This article was written with a strong focus on originality, depth, SEO optimization, and full compliance with Google AdSense policies. It is educational, realistic, and avoids exaggerated claims. The purpose of this content is to help readers understand how financial stress and daily habits influence each other and how small, intentional changes can create a healthier and more sustainable financial life.

Understanding Financial Stress Beyond Money Numbers

Financial stress is often misunderstood as a simple reaction to a lack of money. While limited income or high expenses can certainly contribute, financial stress is not determined solely by numbers on a bank statement. It is strongly influenced by perception, uncertainty, and lack of control.

Two people with similar financial situations can experience very different levels of stress depending on their habits, mindset, and routines. One may feel overwhelmed and anxious, while the other feels cautious but calm. This difference often comes down to daily behaviors and how consistently finances are managed.

Understanding financial stress as a behavioral and emotional experience rather than a purely financial one opens the door to meaningful change.

How Daily Habits Shape Financial Stability

Daily habits form the foundation of financial stability. These habits include how often you check your finances, how you respond to expenses, how you plan ahead, and how you make spending decisions.

When habits are intentional and consistent, they create predictability. Predictability reduces uncertainty, and reduced uncertainty lowers stress. On the other hand, inconsistent or avoidant habits increase unpredictability, which fuels anxiety.

Financial stability is rarely built through occasional big actions. It is built through small, repeated behaviors that gradually create structure and control.

The Cycle Between Financial Stress and Behavior

Financial stress and daily habits often reinforce each other in a cycle. Stress can lead to unhealthy financial behaviors, and those behaviors can increase stress even further.

For example, someone who feels anxious about money may avoid checking their bank account. This avoidance leads to lack of awareness, missed bills, or overspending, which then increases stress. Over time, this cycle becomes difficult to break.

Recognizing this cycle is essential. Once people understand how stress and habits interact, they can begin to interrupt the pattern with small but effective changes.

Emotional Responses and Financial Decisions

Emotions play a powerful role in financial behavior. Stress, fear, frustration, and guilt can influence decisions in ways that logic alone cannot.

Under financial stress, people may make impulsive purchases as a way to cope emotionally. Others may become overly restrictive, avoiding necessary expenses out of fear. Both responses can create additional problems over time.

Daily habits that include emotional awareness, such as pausing before purchases or reflecting on spending decisions, help reduce the emotional impact of financial stress.

The Role of Routine in Reducing Financial Anxiety

Routine is one of the most effective tools for reducing financial stress. When financial tasks are integrated into regular routines, they become less intimidating and more manageable.

Simple routines such as reviewing expenses weekly, planning spending ahead of time, or setting aside savings regularly create a sense of order. This order reduces the mental burden associated with uncertainty.

Routine transforms financial management from a source of anxiety into a predictable and controlled process.

How Avoidance Increases Financial Stress

Avoidance is a common response to financial stress. When money feels overwhelming, many people choose to ignore it altogether.

While avoidance may provide temporary emotional relief, it almost always increases stress in the long run. Unchecked expenses, missed obligations, and lack of planning compound problems silently.

Replacing avoidance with gentle, consistent engagement is one of the most effective ways to reduce financial stress over time.

Small Habits That Reduce Daily Financial Pressure

Small habits can significantly reduce daily financial pressure when practiced consistently. These habits do not require advanced knowledge or drastic lifestyle changes.

Examples include tracking expenses briefly each day, planning meals to reduce last-minute spending, or reviewing upcoming bills regularly. Each habit adds a layer of predictability and control. When these habits become routine, financial stress gradually decreases because fewer surprises occur.

How Financial Stress Affects Decision-Making

Financial stress affects cognitive function and decision-making. Under stress, the brain prioritizes immediate relief over long-term outcomes.

This can lead to decisions that provide short-term comfort but create long-term problems, such as impulse spending or ignoring future obligations.

Healthy daily habits create space between emotion and action. This space allows for more thoughtful and intentional financial decisions.

The Connection Between Time Management and Money Stress

Time management and financial stress are closely connected. Poor time management often leads to rushed financial decisions, missed deadlines, and unnecessary expenses.

Daily habits that improve time awareness, such as planning the week ahead or scheduling financial check-ins, reduce last-minute pressure.

Better time management supports better financial choices and reduces stress caused by urgency and disorganization.

Financial Stress and Sleep, Focus, and Well-Being

Financial stress rarely stays isolated. It often affects sleep, focus, and overall well-being. Lack of sleep and mental fatigue make it harder to maintain healthy habits, creating a feedback loop that worsens financial stress.

Establishing calming routines around finances, such as handling money matters earlier in the day or setting clear boundaries, supports both mental and financial health.

Building Awareness as a Stress-Reduction Tool

Awareness is one of the most powerful tools for reducing financial stress. Knowing where you stand financially reduces fear of the unknown.

Daily habits that promote awareness, such as checking balances or reviewing spending, transform vague anxiety into concrete information. Information creates options, and options reduce stress.

How Consistency Builds Emotional Safety Around Money

Consistency creates emotional safety. When financial behaviors are consistent, money feels less unpredictable. This emotional safety allows individuals to approach finances calmly rather than reactively. Over time, confidence replaces anxiety. Consistent habits build trust in your ability to manage financial challenges effectively.

Breaking the Stress-Habit Loop Gradually

Breaking the cycle between financial stress and unhealthy habits does not require immediate perfection. Gradual change is more effective and sustainable.

Introducing one small habit at a time reduces resistance and increases success. Over time, these habits reshape behavior and emotional responses. Gradual change respects the emotional reality of financial stress while still promoting progress.

How Planning Ahead Reduces Financial Stress

Planning ahead is a powerful stress-reduction strategy. When future expenses are anticipated, they lose much of their emotional impact. Daily or weekly planning habits help distribute financial pressure over time rather than allowing it to accumulate. Planning does not eliminate challenges, but it makes them manageable.

The Importance of Self-Compassion in Financial Habits

Self-compassion is often overlooked in financial discussions. Harsh self-criticism increases stress and discourages consistency. Approaching finances with patience and understanding encourages long-term habit formation. Self-compassion allows individuals to learn from mistakes without becoming stuck in guilt or avoidance.

How Healthy Habits Improve Long-Term Financial Well-Being

Healthy daily habits gradually improve financial well-being by creating structure, awareness, and control. As habits improve, stress decreases, decision-making improves, and confidence grows. This positive feedback loop supports long-term financial stability and peace of mind.

Financial Stress Is a Signal, Not a Failure

Financial stress is often interpreted as personal failure, but it is better understood as a signal that adjustments are needed. Daily habits provide a practical and accessible way to respond to this signal constructively.

Viewing stress as information rather than judgment changes the way people engage with their finances.

Creating a Healthier Relationship Between Money and Daily Life

A healthier relationship with money is built through daily interactions, not occasional efforts. When financial habits support clarity and intention, money becomes a manageable part of life rather than a constant source of worry. This relationship improves overall quality of life and emotional well-being.

Small Daily Changes Create Long-Term Relief From Financial Stress

Small daily changes are more effective than drastic interventions when it comes to reducing financial stress.

Each small habit reduces uncertainty and builds resilience over time. Consistency transforms financial stress from an overwhelming burden into a manageable challenge.

Financial Well-Being Is Built One Habit at a Time

Financial well-being is not achieved through perfection or dramatic change. It is built through consistent, intentional habits practiced daily.

By understanding the relationship between financial stress and daily habits, individuals gain the power to make meaningful improvements. Small, thoughtful changes can lead to lasting relief, greater confidence, and a healthier financial life.

Nanda Cardoso is a personal finance writer focused on financial education, money habits, and financial well-being. The content published on this site is for educational purposes only and does not constitute financial advice.